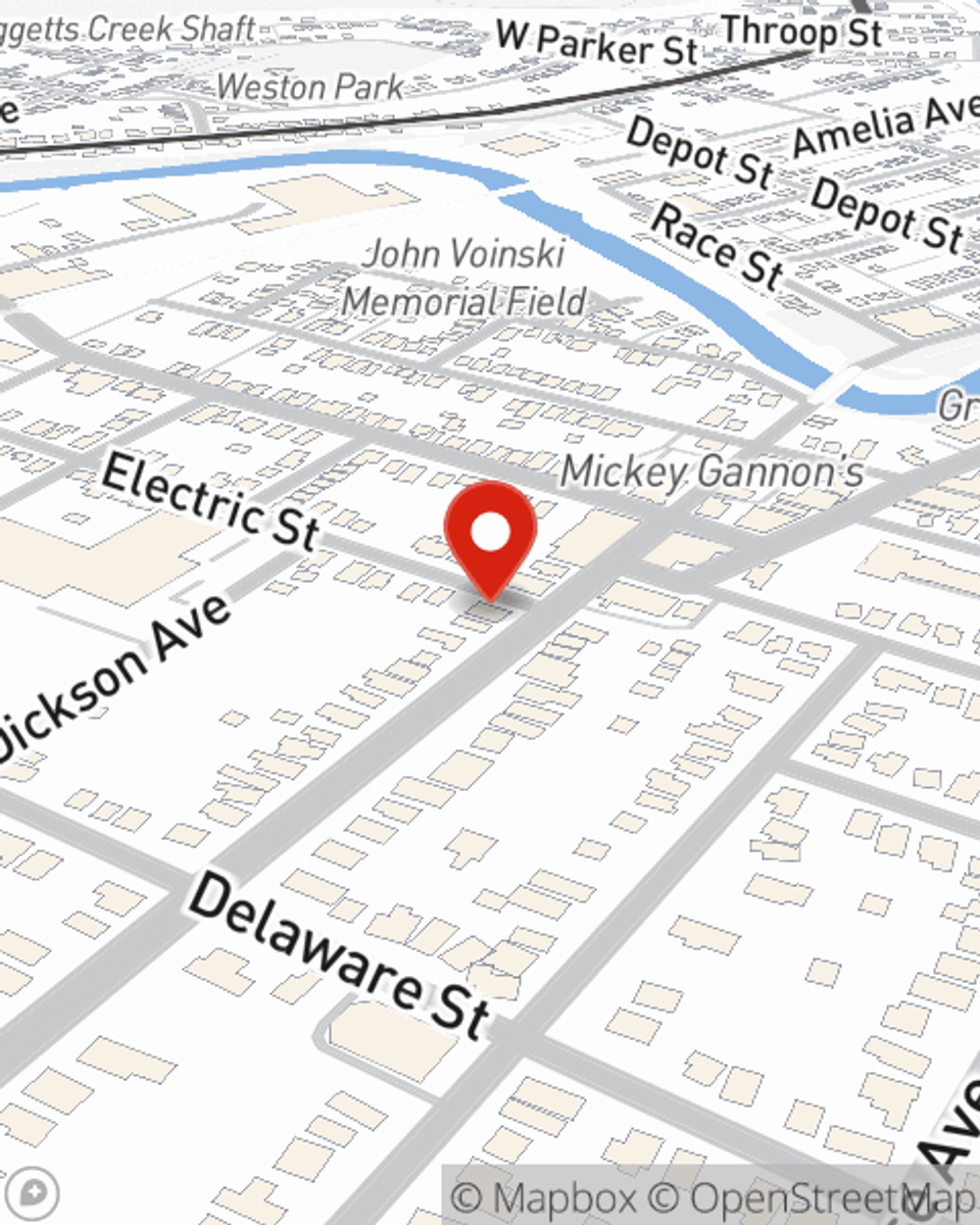

Life Insurance in and around Scranton

State Farm can help insure you and your loved ones

Now is the right time to think about life insurance

Would you like to create a personalized life quote?

- Scranton

- Dunmore

- Dickson City

- Peckville

- Throop

- Jessup

- Blakely

- Archbald

- Clarks Summit

- Waverly

- Dalton

- Moscow

- Old Forge

- South Abington Twp

- Taylor

- Jefferson Township

- Carbondale

- Nicholson

- Factoryville

- Moosic

Your Life Insurance Search Is Over

No one likes to contemplate death. But taking the time now to arrange a life insurance policy with State Farm is a way to express love to your loved ones if you pass away.

State Farm can help insure you and your loved ones

Now is the right time to think about life insurance

Scranton Chooses Life Insurance From State Farm

The beneficiary designated in your Life insurance policy can help cover certain expenses for your partner when you pass away. The death benefit can help with things such as ongoing expenses, grocery bills or car payments. With State Farm, you can rely on us to be there when it's needed most, while also providing caring, dependable service.

If you're looking for dependable coverage and caring service, you're in the right place. Visit State Farm agent Courtney Lisk now to get started on which Life insurance options are right for you and your loved ones.

Have More Questions About Life Insurance?

Call Courtney at (570) 800-5969 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Questions to ask your insurance agent

Questions to ask your insurance agent

Insurance needs are ever-changing. Here are some questions to ask an insurance agent to start the conversation and further explore your coverage options.

Whole Life insurance

Whole Life insurance

What is the difference between Ordinary life and Limited-payment life? Read about some common uses for Whole Life Insurance.

Courtney Lisk

State Farm® Insurance AgentSimple Insights®

Questions to ask your insurance agent

Questions to ask your insurance agent

Insurance needs are ever-changing. Here are some questions to ask an insurance agent to start the conversation and further explore your coverage options.

Whole Life insurance

Whole Life insurance

What is the difference between Ordinary life and Limited-payment life? Read about some common uses for Whole Life Insurance.